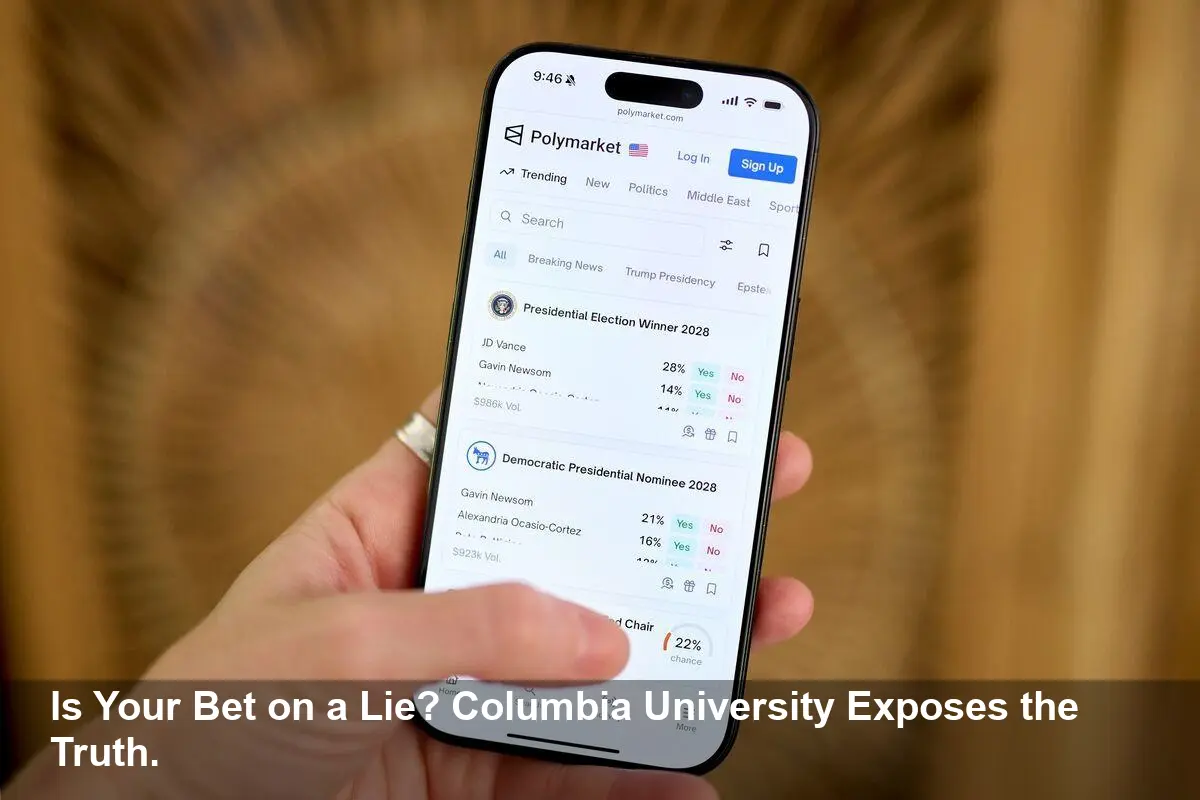

Polymarket Volume a Sham? Study Finds 25% is Fake

- A new study from Columbia University researchers has uncovered significant 'artificial' trading activity on the prediction market platform Polymarket.

- The research indicates that, on average, 25% of all buying and selling on the platform over the last three years was due to wash trading.

- Wash trading is the practice of users rapidly buying and selling the same contracts to create a false impression of high market activity.

- These findings raise serious questions about the true volume and liquidity on one of the most popular prediction markets.

Columbia University Exposes Inflated Polymarket Activity

A startling new study conducted by researchers at Columbia University has cast a shadow over the trading volumes of Polymarket, a leading platform in the prediction market space. The report concludes that a significant portion of the platform's activity has been artificially inflated through a practice known as wash trading.

A Quarter of All Volume Deemed 'Artificial'

According to the in-depth academic study, which analyzed three years of transaction data, an average of 25% of all trading volume on Polymarket was not genuine. The authors label this activity “artificial trading,” highlighting a persistent pattern of users buying and selling the same contracts in rapid succession. This method is a hallmark of wash trading, a manipulative practice designed to mislead observers about a market's popularity and liquidity.

What is Wash Trading?

Wash trading is a form of market manipulation where an entity simultaneously sells and buys the same financial instruments. The goal is to create misleading, artificial activity in the marketplace. While it doesn't represent genuine market interest, the inflated numbers can attract unsuspecting traders by making a platform or specific contract appear more active and desirable than it actually is.

Implications for the Prediction Market

The conclusions from the Columbia University study challenge the reputation of Polymarket, which, according to industry analysis, has been the top prediction market for most of the past year. Inflated volumes can provide a false sense of security and liquidity to users, potentially influencing their trading decisions based on inaccurate data. The report's findings are a critical warning for participants in the burgeoning world of prediction markets, emphasizing the need for greater transparency and scrutiny.