Ex-FTX Chief Launches Exchange You Can’t Ignore

- From FTX to the Future: Former FTX US President Brett Harrison has launched Architect (AX), a new, fully regulated global exchange.

- Bridging Two Worlds: AX introduces crypto-style perpetual futures contracts to traditional assets like stocks, forex, and commodities.

- Major Backing: The venture has already secured $17 million in a Series A funding round from industry giants including Coinbase Ventures, Circle Ventures, and Anthony Scaramucci's SALT Fund.

- Regulated and Secure: The platform operates under a dual-licensing structure from the Bermuda Monetary Authority, aiming to prevent another FTX-style disaster.

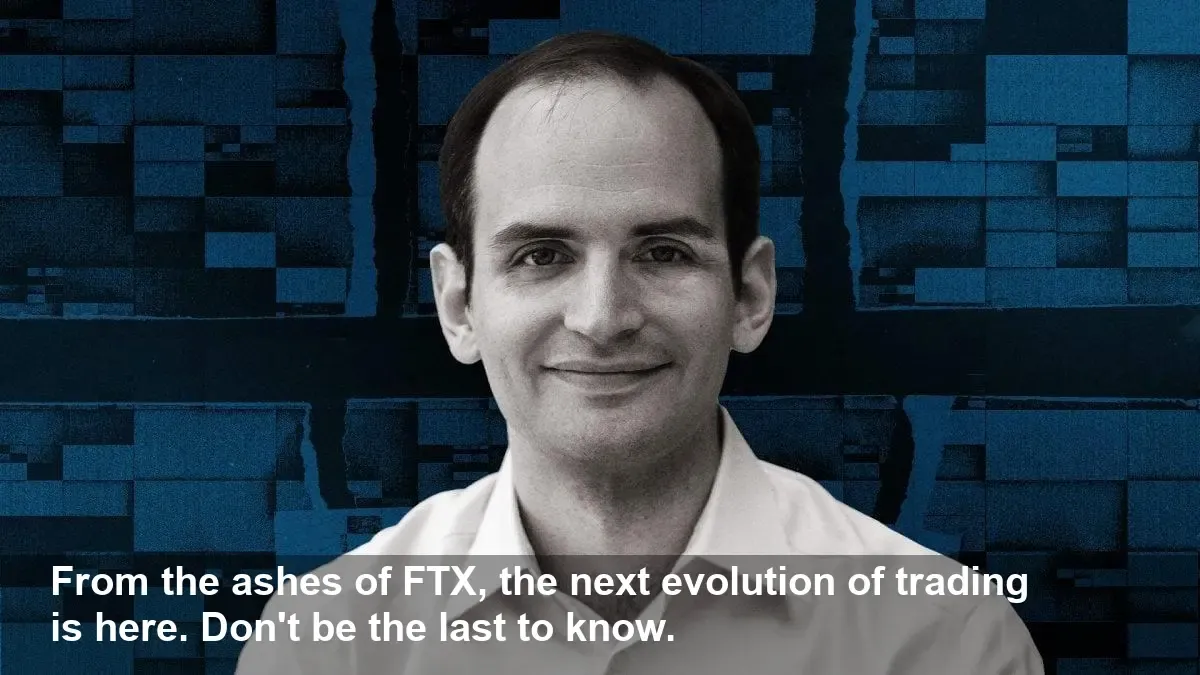

Out of the Ashes: Former FTX US Head Launches Groundbreaking Exchange

In a move that’s turning heads across the financial world, Brett Harrison, the former president of FTX US, has launched Architect Financial Technologies' new global exchange, AX. Stepping out from the long shadow of the FTX collapse, Harrison is introducing a platform designed to merge the innovative efficiency of cryptocurrency markets with the robust security of traditional finance.

AX is not just another trading venue. Its core offering is crypto-style perpetual futures—contracts without an expiry date—for a wide range of traditional assets. This includes everything from single stocks and major indexes to foreign currencies, metals, and energy commodities, a concept largely confined to the crypto space until now.

A New Model for Trading

Drawing from his experiences at FTX US, Citadel Securities, and Jane Street, Harrison aims to correct the failures of the past. AX is built to blend the "capital efficiency and operational simplicity of crypto perps with the security, transparency, and regulatory oversight of traditional futures exchanges," Harrison explained on X.

This means implementing critical safeguards absent from many crypto platforms, such as price bands, volatility halts, and default waterfalls, all while operating on a centrally cleared, anonymous order book.

I’m thrilled to announce the launch of Architect’s new institutional exchange, AX!

AX will offer futures on a wide range of traditional assets, but with the structure and capital efficiency of crypto perps, and with the safety and security of a regulated US-based company.…— Brett Harrison (@BrettHarrison88) October 29, 2025

Backed by the Best in the Business

The project’s potential hasn't gone unnoticed. Architect is in its Series A funding round and has already raised an impressive $17 million. The list of investors serves as a powerful vote of confidence, featuring heavyweights like Coinbase Ventures, Circle Ventures, and Anthony Scaramucci’s SALT Fund. This powerful backing confirms that many industry leaders believe in Harrison's vision for a more integrated and secure financial future.

Security and Accessibility First

Operating under the watchful eye of the Bermuda Monetary Authority, Architect Bermuda Ltd. is licensed to ensure regulatory compliance. In a direct lesson from the FTX saga, customer funds are a top priority. AX allows clients to post collateral in both U.S. dollars and stablecoins, with custody managed by established banking partners, not the exchange itself.

Initially, AX is opening its doors to institutional clients, including hedge funds, market makers, and asset managers. However, a waitlist is now available for qualified individual traders, signaling that you won’t want to be late to this new frontier in trading.