Skimmer Found at Family Dollar: Is Your Money Safe?

- A credit card skimmer was discovered at the Family Dollar on 32nd Street Northeast in Cedar Rapids.

- The Cedar Rapids Police Department confirmed the finding and has launched an active investigation.

- Details are limited as the investigation is ongoing, but the incident highlights a growing national security threat.

- The FBI reports that credit card skimmers cost American consumers and financial institutions over a billion dollars annually.

Police Investigate Skimmer at Cedar Rapids Store

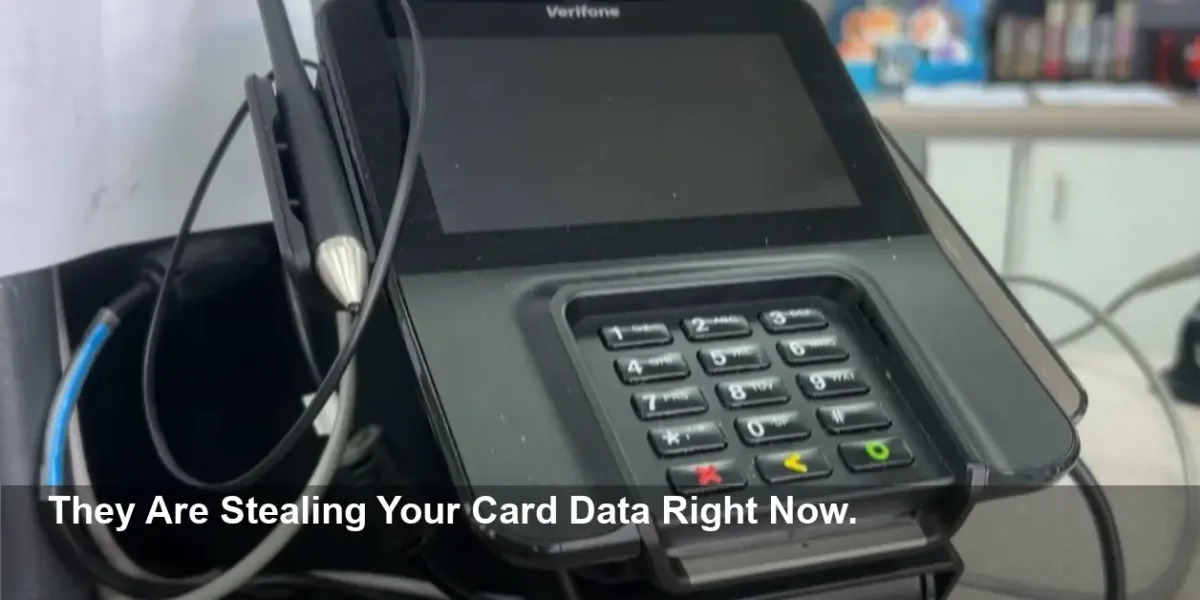

CEDAR RAPIDS, Iowa – Shoppers at a local Family Dollar are on high alert after the Cedar Rapids Police Department confirmed the discovery of a credit card skimmer at one of its locations. The malicious device, designed to steal credit and debit card information, was found on Tuesday morning at the store located on 32nd Street Northeast, near Oakland Road.

Authorities have launched an active investigation into the security breach. However, due to the sensitive and ongoing nature of the case, police officials have declined to provide additional information regarding how the skimmer was found or how long it may have been in place. The discovery has put a spotlight on the vulnerability of everyday payment terminals and the sophisticated methods criminals use to exploit them.

A Billion-Dollar National Problem

This incident in Cedar Rapids is not an isolated event but part of a disturbing nationwide trend. According to the FBI, these skimming devices cost American consumers and banks more than a billion dollars every year. Criminals place these small, often unnoticeable devices over legitimate card readers at ATMs, gas station pumps, and retail checkout counters. When a customer swipes their card, the skimmer secretly records the data from the magnetic stripe.

Reports from across the country, including major metro areas like Portland and states like South Carolina, show that these scams are becoming increasingly common. The captured data is often sold on the dark web or used to create counterfeit cards, leading to fraudulent purchases and drained bank accounts long before the victim is aware their information has been compromised.

How to Protect Your Financial Information

While law enforcement works to combat this threat, consumers are urged to be vigilant. Security experts recommend taking a few simple precautions every time you use your card:

- Physically Check the Card Reader: Before inserting or swiping your card, give the terminal a gentle tug or wiggle. Skimmers are often loosely attached overlays that will feel insecure.

- Inspect for Tampering: Look for mismatched colors, graphics that don't align, or unusual components. Criminals often try to make their devices blend in, but close inspection can reveal inconsistencies.

- Cover the PIN Pad: Always use your other hand to shield the keypad when entering your PIN. Hidden cameras are frequently used in conjunction with skimmers to capture your personal identification number.

- Monitor Your Accounts: Regularly review your bank and credit card statements for any unauthorized transactions. If you notice suspicious activity, report it to your financial institution immediately.

As the investigation in Cedar Rapids continues, residents are reminded to stay cautious and report any suspicious devices they may encounter.