Most Played New Games of 2025

Key Takeaways:

- Battlefield 6 led 2025’s new releases with ~26M players; base game sold 20M+ copies.

- Free-to-play Skate reached 23M players and sustains 750K+ daily active users.

- Top new indies on Steam generated over $500M combined (about 3% of Steam’s ~$18B yearly revenue).

- R.E.P.O, PEAK, and several premium titles (Expedition 33, Monster Hunter Wilds) posted strong sales and retention signals.

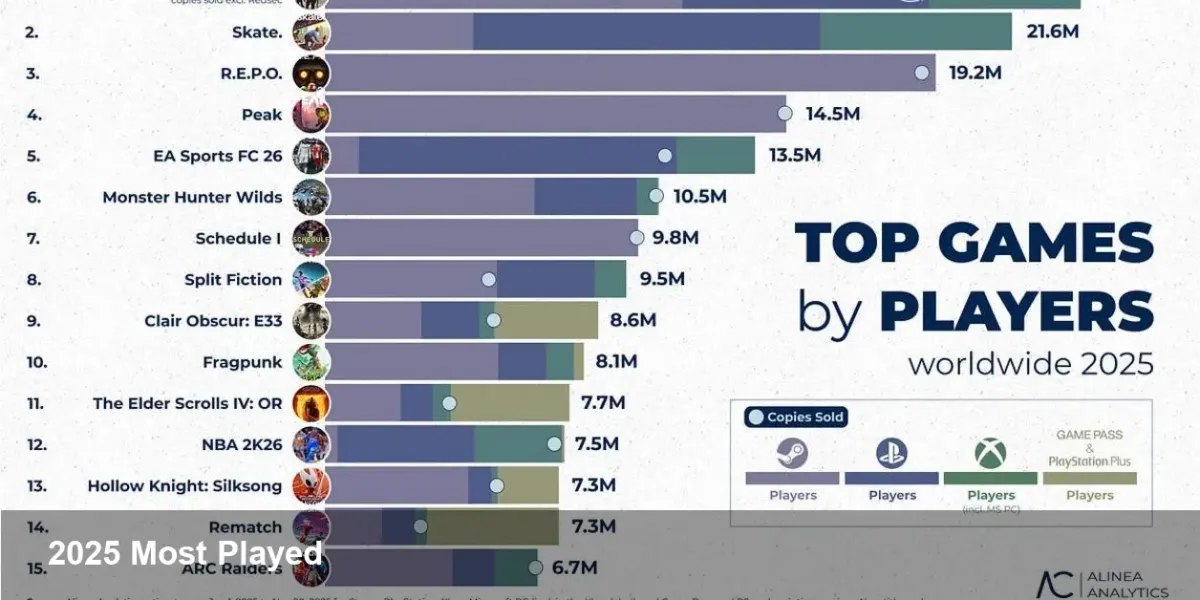

Top new games by player count

Battlefield 6 — Franchise resurgence

Battlefield 6 topped the list with roughly 26 million players in 2025, a figure that includes the free-to-play REDSEC component. The base premium game has sold over 20 million copies.

Analysts attribute the rebound to DICE and EA returning to classic franchise elements and listening to community feedback, delivering a multiplayer experience that resonated at scale.

Skate — A free-to-play cultural moment

EA’s free-to-play Skate reboot hit about 23 million players in 2025. By lowering the barrier to entry and emphasizing creator-driven content, skate. became a social platform as much as a sports title.

It maintains more than 750,000 daily active users and outdrew some premium competitors in raw player numbers.

R.E.P.O and PEAK — Viral co-op and emergent play

Co-op horror R.E.P.O reached about 19.6 million players, driven by viral prox-chat moments and a loop that blends tactical depth with chaotic emergent fun.

PEAK passed 15 million players on Steam, standing out for physics-driven climbing mechanics and memorable social moments that fueled streaming and community growth.

EA Sports FC 26

EA Sports FC 26 ranked #5 in player reach. Roughly 92% of its players are on console, with PlayStation accounting for about 68% of the user base.

Copies sold on PS5/PS4 are down about 15% year-over-year, but revenues increased thanks to stronger monetization and Ultimate Team mechanics.

Steam revenue and indie performance

Steam’s $18B year and indies’ share

Estimated gross revenue on Steam for the year was about $18 billion. The top five new indie releases of 2025 together generated over $500 million—roughly 3% of that total.

Leading indie earners

Notable indie revenues included Schedule I (~$151M), Silksong (~$75M), and Escape from Duckov (~$53M). These titles show publishers and platforms can still deliver major returns from smaller teams when discovery and community hooks align.

Other notable sales and trends

Expedition 33, Monster Hunter Wilds, Split Fiction

Expedition 33 has sold over 6.1 million copies, with 57% of sales on Steam and a boost of roughly 500,000 copies after a Game Awards spotlight.

Monster Hunter Wilds is approaching 11 million copies sold, though about 90% of those sales concentrated in the launch month, indicating weaker tail retention versus previous entries.

Split Fiction has sold over 5 million copies, with more than one-third of its player base coming from China.

What this means

2025’s winners underline two clear patterns: social, creator-friendly free-to-play experiences can rapidly scale audiences, while strong IP and live-service monetization still drive revenue in premium franchises. Indies continue to punch above their weight when discovery and community engagement align.