Oracle Stock Plummets 24%: Is AI Dream a Debt Nightmare?

- Massive Cash Burn: Oracle is spending billions in an aggressive pivot to become an AI cloud-computing giant, a move that is rapidly depleting its cash reserves.

- Surging Debt Concerns: The company may need to issue an additional $65 billion in bonds, pushing its debt to levels that are making credit markets nervous.

- Investor Confidence Drops: Reflecting growing anxiety, Oracle's stock has plunged 24% this month amid an uptick in trading of its credit-default swaps.

- Credit Rating at Risk: Analysts warn that Oracle must maintain its investment-grade credit rating to secure the massive funding required for its AI ambitions.

Oracle's High-Stakes Bet on AI Sparks Investor Panic

Oracle is navigating a treacherous path, risking its financial stability on a massive transformation into an artificial intelligence powerhouse. The software veteran, once hailed as an AI darling on Wall Street, is now facing a harsh reality check as its colossal spending strategy raises serious alarms among investors. The company's shares have tanked by a staggering 24% this month, signaling a deep-seated concern over its costly ambition.

The AI Dream Fueled by a Mountain of Debt

The core of the issue lies in Oracle's aggressive spending to build out the infrastructure for a leading AI cloud-computing service. This venture involves leasing vast clusters of advanced computer chips necessary to power generative AI applications like OpenAI's ChatGPT. The problem? This transformation is burning through cash at an alarming rate, with plans to spend tens of billions more over the next few years.

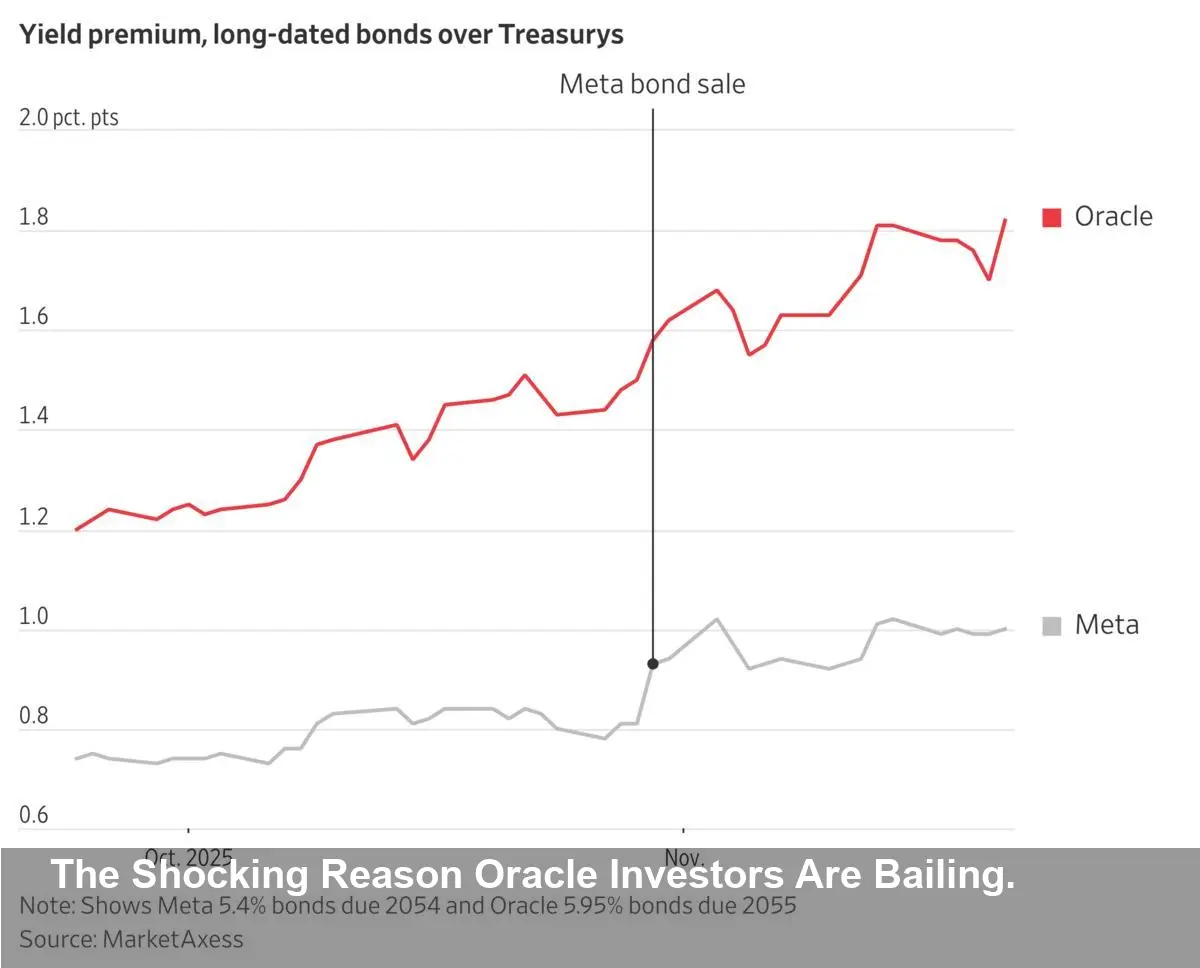

To finance this pivot, Oracle is leaning heavily on debt markets. According to Jordan Chalfin, a senior analyst at research firm CreditSights, Oracle could issue approximately $65 billion more in bonds over the coming three years. This potential debt load has pushed the yields on Oracle's existing bonds higher than almost all of its investment-grade tech counterparts, a clear indicator of perceived risk.

Why a Credit Rating Downgrade Could Be Catastrophic

Chalfin notes that while a modest increase in borrowing costs might not derail the company, a slip in its credit rating could be devastating. Oracle, currently rated just two notches above speculative-grade (or "junk") territory, must maintain its investment-grade status. The funding pool available to lower-rated companies is simply not large enough to support the gargantuan capital expenditures Oracle has planned.

Market Jitters Turn into a Sell-Off

The growing anxiety is palpable in the financial markets. Recent weeks have seen a notable increase in the trading of Oracle's credit-default swaps—complex financial instruments that investors use to hedge against the risk of a company defaulting on its debt. While bond investors haven't been shocked by the activity, the increased focus on Oracle's credit risk has undoubtedly contributed to the negative sentiment weighing on its stock.

For investors, Oracle's journey is now a high-wire act. The company is betting the house on a successful transition to AI cloud computing, but the enormous upfront cost and mounting debt have created a precarious situation, leaving Wall Street to wonder if the dream of AI dominance will instead become a financial nightmare.