Why Intel's Nova Lake-S Delay Matters for PC Buyers and Developers

A reset on the calendar: Nova Lake-S slides into early 2027

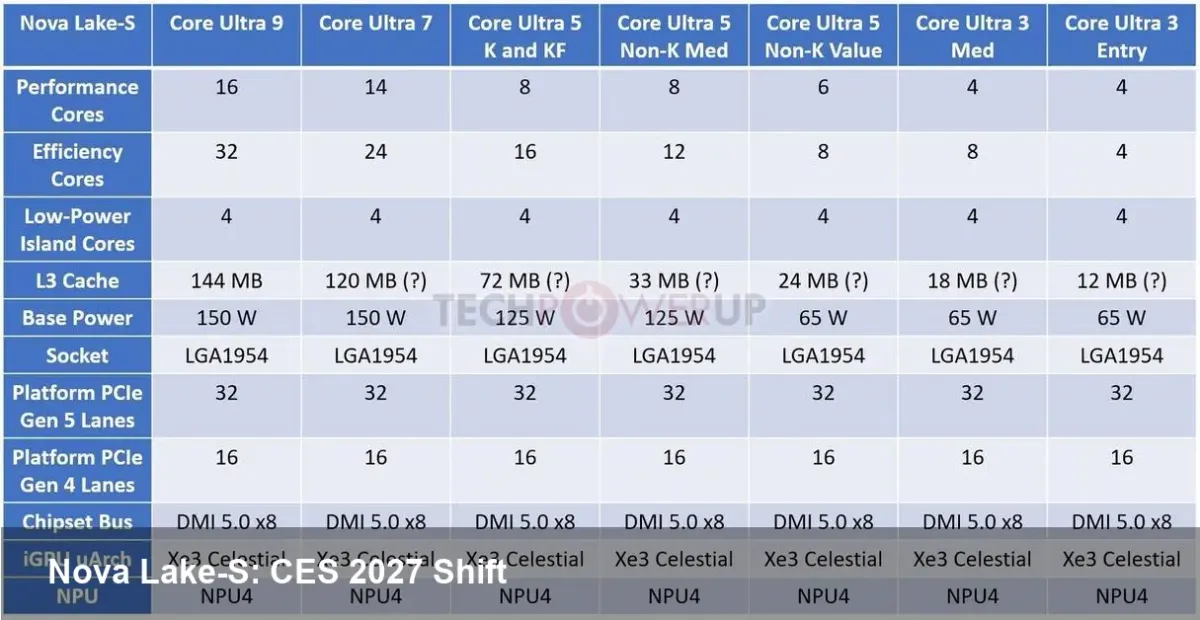

Intel appears to be repositioning its next desktop silicon, Nova Lake-S (expected as part of the Core Ultra Series 4 family), for an early-2027 debut at CES rather than the previously rumored late-2026 launch. At the same time, AMD’s next-generation Zen 6 desktop Ryzen platform (codenamed Olympic Ridge in leaks) is also rumored to be shifting into 2027. The result: two major platform refreshes may land around the same event window, changing timing and tactics across customers, OEMs, and developers.

This article walks through the practical implications of that slip for different audiences—prosumer buyers, OEMs and system integrators, software developers, and IT procurement teams—and outlines a few strategic takeaways to watch as CES 2027 approaches.

Quick context: what is Nova Lake-S and why Core Ultra matters

Intel’s Core Ultra branding marks the company’s push to integrate new hybrid CPU architectures, energy-efficient accelerators, and tighter chiplet-level integration into mainstream desktop and mobile processors. Nova Lake-S is the desktop-oriented product line in that Series 4 wave and is meant to succeed the current generation with updated architectures and platform features.

In parallel, AMD’s Zen 6-based desktop processors (leaked under names like Olympic Ridge) were expected to be the company’s next step in performance-per-watt and platform feature enhancements. With both camps reportedly shifting launch windows into early 2027, the competitive landscape for the next wave of consumer and professional CPUs will likely look different than initially expected.

What a postponement actually means for buyers

- Short-term buying: If you need a PC today, you no longer have to worry you’ll miss out by buying a system “just before” Nova Lake-S or Zen 6 arrives. Current-gen chips will stay relevant longer, and any price drops may be gradual.

- Waiting dilemma: Enthusiasts who chase the absolute newest silicon will have to wait several more months. Expect mid-cycle refreshes and OEM bundles to fill the gap (special edition SKUs, motherboard BIOS updates, or factory-overclocked variants).

- Used and refurbished market: A delay compresses the refresh cycle, which tends to soften trade-in values less dramatically than a rapid influx of new stock. That could be relevant if you plan to buy last-generation hardware as a lower-cost alternative.

Concrete scenario: If a content-creator needs a workstation in Q4 2026, it’s likely smarter to buy now and optimize workflow than to postpone for a potential CES 2027 uplift. The same system will still be solid for typical workloads while vendors finalize next-gen boards and drivers.

OEMs and supply-chain consequences

OEMs calibrate production months in advance. Moving a major desktop launch from late 2026 into CES 2027 means:

- Manufacturing and logistics queues will stay saturated with current-platform orders longer.

- Motherboard vendors will get extra time to finalize BIOS support, silicon validation, and platform I/O choices (PCIe lanes, memory support, power delivery tweaks).

- The timing creates an opportunity for seasonal sales (Black Friday, year-end) to clear inventory ahead of the CES window rather than squeeze product launches into the holiday rush.

For a system integrator, this could mean smoother rollouts and better-tested BIOSs at launch, but also a longer period of uncertainty on component pricing tied to next-gen features.

Developers: remember the software side of the silicon story

The value of new CPU microarchitectures depends heavily on software that actually leverages them. Nova Lake-S is expected to continue the industry’s hybrid-core trend and expand accelerator presence on-chip—both of which require attention from software teams:

- Thread scheduling: Hybrid core designs require OS and runtime schedulers that place background and latency-sensitive threads correctly. Developers should test workloads on hybrid and symmetric core systems to avoid regressions.

- Compiler and toolchain updates: New instruction sets and microarchitecture tweaks often produce measurable gains when compilers are updated. CI pipelines should be prepared to run performance regressions on newer toolchain builds.

- Games and real-time apps: Timing-sensitive engines should revisit thread affinity and workload partitioning. Waiting until final silicon is shipping before heavy optimizations can make launches smoother.

Example: A multiplayer game studio planning a major patch in Q1 2027 should validate server and client builds on pre-release hardware and updated OS kernels to avoid scheduling inconsistencies that can affect latency.

Enterprise and procurement planning

For IT teams planning refresh cycles, a few practical notes:

- Budget timelines: If refreshes were budgeted for late 2026 based on assumed arrival of new chips, those timelines need updating. Leasing and lifecycle models might move into 2027, altering depreciation and refresh cadence.

- Security and platform features: New platform launches often bring changes in firmware-level security, platform-attestation options, and virtualization optimizations. Procurement should map desired features to vendor roadmaps rather than fixed calendar dates.

Scenario: A corporate laptop refresh slated for Q4 2026 may either push forward into Q1 2027 to align with new silicon that brings security features, or proceed earlier if the security gap is minimal and cost predictability is more important.

Competitive dynamics and market effects

Two big entries converging on CES 2027 could amplify competition:

- Pricing pressure: If both Intel and AMD coordinate launches around the same time, expect aggressive introductory pricing and bundled promotions from OEMs.

- Marketing noise: CES has historically amplified launches; simultaneous debuts will create a crowded narrative where product differentiation (software, platform features, thermal/power envelopes) becomes decisive.

- Performance expectations: Press and reviewers will directly compare platform features and real-world workloads rather than synthetic numbers, increasing the emphasis on platform maturity (drivers, firmware) at launch.

Three forward-looking takeaways

- Software-first optimization wins: The longer timeline gives developers and OS vendors more runway to tune schedulers, compilers, and runtimes for hybrid and accelerator-heavy architectures.

- Buying windows expand: Consumers and enterprises get a more forgiving purchase window—buy now for stable, known-good systems, or wait until CES 2027 for new features and likely promotions.

- CES remains critical: Moving these launches into CES underscores the show’s role as a platform-shaping moment for PC hardware, concentrating attention (and comparisons) into a single major event.

What to watch next

Over the next months look for motherboard vendors to publish platform feature lists, OS update notes (scheduler changes), and OEM plans for CES. If you’re making buying, deployment, or optimization decisions, those signals will be more informative than the rumor mills.

If you’re an enthusiast thinking of waiting: factor in your immediate needs, the cost of delay, and whether software support for new architectures will be ready at launch. For developers and IT buyers, use the extra lead time to test and plan so the transition to Nova Lake-S or Zen 6 systems is smooth when they arrive.