When Integral Ad Science (IAS) Moves, Investors Should Take Notice

Integral Ad Science Holding Corp. (IAS), a leading provider of digital ad quality and brand safety solutions, has recently shown notable price action, attracting the attention of investors and traders. This article delves into the technical analysis of IAS, providing insights into potential trading opportunities based on various timeframes.

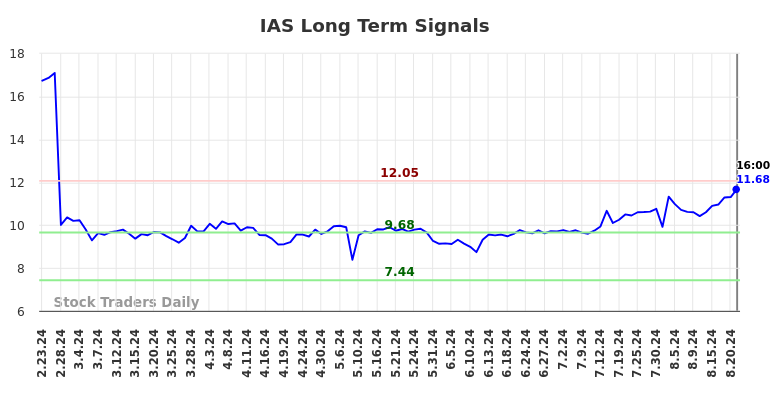

Long-Term Trading Plans for IAS

The technical analysis suggests a buy signal for IAS near £9.69, with a target price of £12.07. This strategy aims to capitalize on a potential upward trend. However, a stop-loss order should be set at £9.66 to mitigate potential losses. This level represents the first support level below £11.68, and a test of this support area is generally seen as a bullish signal.

Conversely, a short position in IAS could be considered near £12.07, targeting £9.69. This short strategy anticipates a downward trend and requires a stop-loss order at £12.1. The £12.07 level represents the first resistance level above £11.68, and a test of resistance is typically a bearish indication.

Swing Trading Plans for IAS

For swing traders seeking shorter-term opportunities, a buy signal emerges if IAS breaks above the £11.75 resistance level. A target price of £12.07 is set for this scenario, with a stop-loss order at £11.72. A break above resistance often signals a change in trend, prompting a buy signal. This strategy is known as a "Long Resistance Plan".

Conversely, a short position in IAS can be considered if the stock tests the £11.75 resistance level. A target price of £11.43 is set for this short strategy, with a stop-loss order at £11.78. This strategy is referred to as a "Short Resistance Plan".

Day Trading Plans for IAS

Similar to the swing trading plans, day traders may opt for a buy signal if IAS breaks above £11.75, aiming for a target of £12.07 and setting a stop-loss at £11.72. Alternatively, a short position can be taken if the stock tests the £11.75 resistance level, targeting £11.43 with a stop-loss at £11.78.

Real-Time Updates and Market Insights

For those seeking real-time updates and deeper market insights, Stock Traders Daily offers a subscription service providing 24/7 access to dynamic analyses and trading signals.

Fundamental Charts for IAS

While this article focuses on technical analysis, it is important to consider fundamental factors influencing IAS's performance. These factors include the company's financial health, competitive landscape, and overall industry trends.

Disclaimer: This article is for informational purposes only and should not be considered as financial advice. Investors should always conduct thorough research and consult with a qualified financial professional before making any investment decisions.