The Rise of Online Insurance: Market Booming with Digital Transformation

The online insurance market is experiencing a dramatic shift as digital transformation continues to reshape the financial services landscape. This surge in demand is expected to propel the market to remarkable heights, according to a recent in-depth study by HTF Market Intelligence.

The report, titled "Global Online Insurance Market Report 2020", provides a comprehensive analysis of this burgeoning sector, highlighting key market dynamics, growth drivers, and anticipated trends. It examines a wide range of aspects, including revenue size, production, consumption, CAGR (Compound Annual Growth Rate), gross margin, pricing, and significant influencing factors.

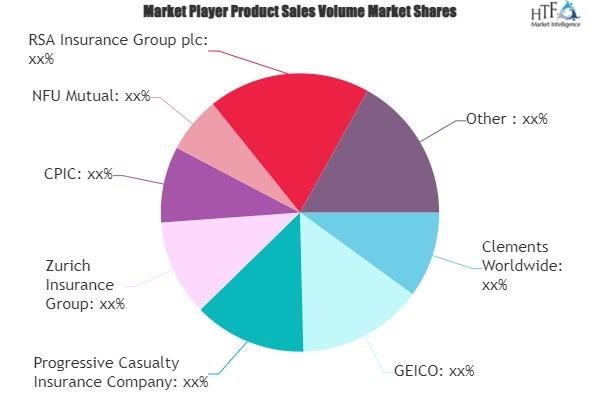

Key Players Leading the Digital Insurance Revolution:

The report spotlights leading players within the online insurance market, including:

Clements Worldwide

GEICO

Progressive Casualty Insurance Company

Zurich Insurance Group

CPIC

NFU Mutual

RSA Insurance Group plc

State Farm Mutual Automobile Insurance Company

Allstate Insurance Company

RAC Motoring Services

ABIC Inc.

Zhongan Insurance

Market Segmentation: Understanding the Landscape:

The study categorises the online insurance market based on types and applications:

Types:

Managed Services

Professional Services

Applications:

Insurance Companies

Third-Party Administrators and Brokers

Aggregators

Global Market Outlook: Regional Growth and Key Takeaways:

The report dissects the global online insurance market across key geographical regions:

APAC (Asia-Pacific)

Europe

North America

South America

MEA (Middle East and Africa)

Key takeaways from the report:

Online insurance is experiencing significant growth driven by digital adoption, convenience, and competitive pricing.

Technological advancements and the increasing adoption of digital channels are key drivers for market expansion.

A burgeoning demand for personalised insurance solutions fuels market growth.

The increasing prevalence of cyber threats poses a significant challenge for online insurers.

The global online insurance market is predicted to see substantial growth over the forecast period (2024-2030).

Future Prospects and Opportunities:

The report forecasts a bright future for the online insurance market, highlighting opportunities for new entrants and established players alike. This includes:

Expanding into emerging markets with high digital penetration.

Developing innovative insurance products tailored to specific customer needs.

Investing in cutting-edge technologies such as AI, machine learning, and blockchain to enhance service offerings and reduce operational costs.

Conclusion:

The online insurance market is poised for continued growth, driven by a confluence of factors, including the digitalisation of financial services, a growing consumer demand for online convenience, and technological advancements. As the market continues to evolve, players who adapt to changing customer needs and embrace innovative solutions are likely to reap the greatest rewards.