Nvidia's Q2 Earnings: A Crucial Test for the "Most Important Stock"

Nvidia, the dominant force in the artificial intelligence (AI) chip market, faces a pivotal moment as it prepares to report its second-quarter earnings on Wednesday. The company's stock, once considered a "joyride" for investors, has recently experienced wild fluctuations, reflecting the intense scrutiny surrounding its performance and the future of the AI boom.

Since the end of 2022, Nvidia's market capitalisation has soared by almost ninefold, riding the wave of AI enthusiasm. However, after reaching a record high in June and briefly claiming the title of the world's most valuable publicly traded company, the stock suffered a steep decline, shedding nearly 30% and £600 billion in value over the next seven weeks.

The recent rally has pushed Nvidia's share price within 7% of its all-time high, making its upcoming earnings announcement a major event for Wall Street. Any hint of waning AI demand or cautious spending from key cloud customers could translate into a significant revenue drop, potentially sending shockwaves across the market.

"It's the most important stock in the world right now," asserted Eric Jackson of EMJ Capital on CNBC's "Closing Bell". "If they lay an egg, it would be a major problem for the whole market. I think they're going to surprise to the upside."

Nvidia's report comes after its megacap tech peers, including Microsoft, Alphabet, Meta, Amazon, and Tesla, have already delivered their earnings results. These companies, all heavy users of Nvidia's graphics processing units (GPUs) for AI model training and data processing, have been closely watched for their spending on Nvidia's hardware.

In the past three quarters, Nvidia's revenue has more than tripled year-on-year, with the majority of this growth stemming from its data centre business. Analysts predict a fourth consecutive quarter of triple-digit revenue growth, albeit at a slightly reduced pace of 112% to £23 billion, according to LSEG.

However, year-over-year comparisons are expected to become increasingly difficult in the coming quarters, with growth predicted to slow down. Consequently, investors will be paying close attention to Nvidia's forecast for the October quarter, with expectations of a 75% increase to £25 billion.

A positive outlook would suggest continued strong investment in AI infrastructure by Nvidia's major clients, while a disappointing forecast could raise concerns about a potential slowdown in spending.

"Given the steep increase in hyperscale capital expenditure over the past 18 months and the strong near-term outlook, investors frequently question the sustainability of the current capital expenditure trajectory," acknowledged analysts at Goldman Sachs, who maintain a "buy" recommendation on the stock.

The recent optimism surrounding Nvidia, with the stock rising by 8% in August, is largely attributed to statements from major customers about their ongoing commitment to investing in data centres and Nvidia-based infrastructure.

Last month, the CEOs of Google and Meta expressed their enthusiasm for the pace of their build-outs, arguing that underinvestment poses a greater risk than overspending. Former Google CEO Eric Schmidt recently stated, in a video that was later removed, that top tech companies are reporting a need for £16 billion, £40 billion, or even £80 billion worth of processors.

However, despite Nvidia's expanding profit margins, questions remain about the long-term return on investment that clients will see from their purchases of these expensive, high-demand GPUs.

During Nvidia's last earnings call in May, CFO Colette Kress provided data suggesting that cloud providers, responsible for over 40% of Nvidia's revenue, would generate £4 in revenue for every £1 spent on Nvidia chips over a four-year period. More such metrics are expected to be shared during the upcoming earnings call, with Goldman Sachs analysts stating that the company plans to provide further "return on investment metrics to instill confidence in investors."

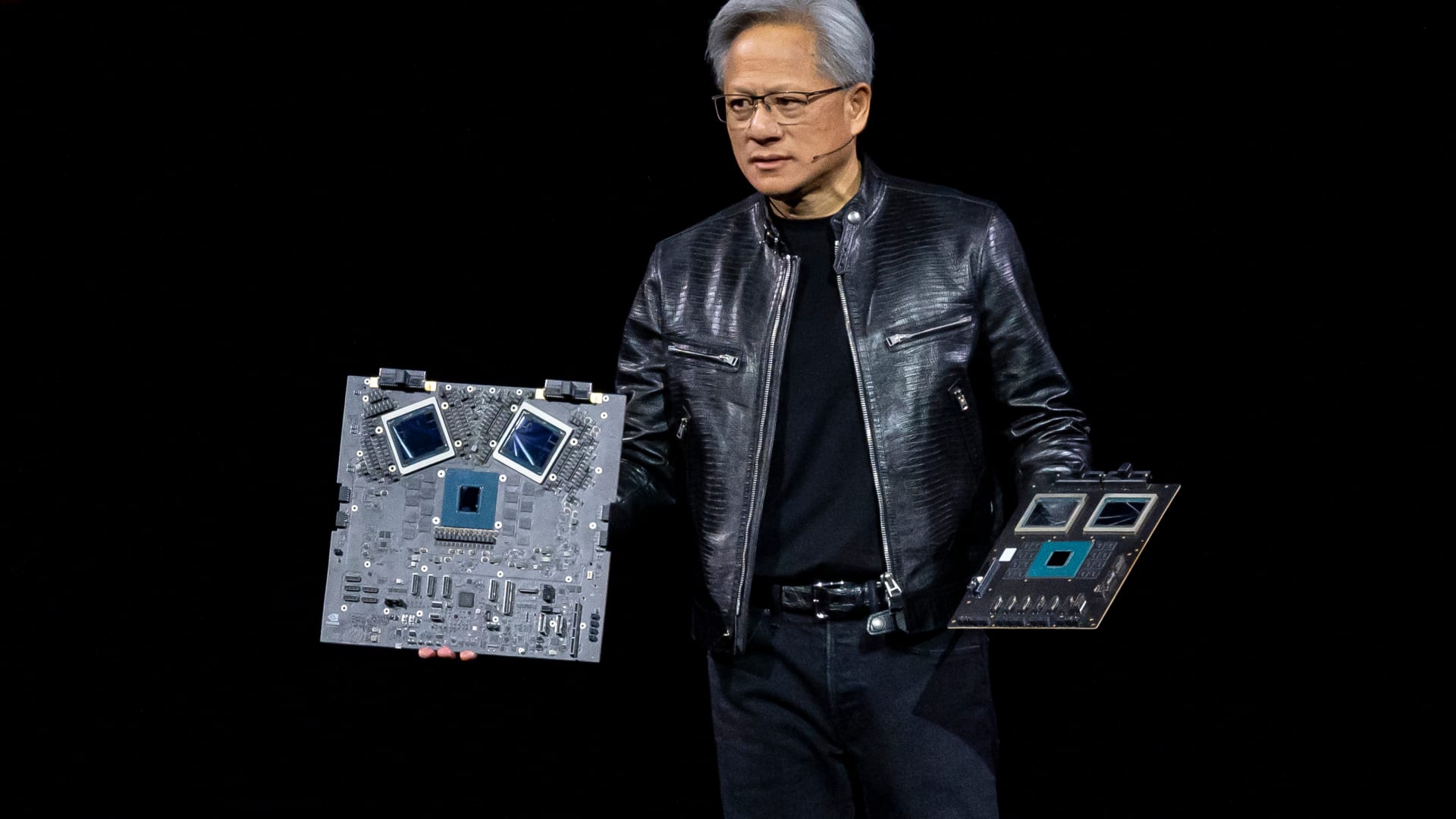

Another key question facing Nvidia is the timeline for its next-generation AI chips, known as Blackwell. The Information reported earlier this month that production challenges are likely to push back major shipments into the first quarter of 2025, despite Nvidia's previous statement that production was on track to ramp up in the second half of the year.

This report comes after CEO Jensen Huang surprised investors in May by indicating that Blackwell would contribute "a lot" to Nvidia's revenue during the current fiscal year. While the current Hopper generation remains the leading choice for deploying AI applications like ChatGPT, competition from AMD, Google, and several startups is intensifying, putting pressure on Nvidia to maintain its performance lead.

A potential delay in Blackwell could simply shift revenue into future quarters while boosting sales of current Hopper chips, particularly the newer H200 chip.

"That shift in timing doesn't matter very much, as supply and customer demand has rapidly pivoted to H200," noted Morgan Stanley analysts.

Nvidia's leading customers require the enhanced processing power of Blackwell chips to train more advanced next-generation AI models, but they are willing to adapt and make do with the current offerings.

"We expect Nvidia to deemphasize its Blackwell B100/B200 GPU allocation in favour of ramping up its Hopper H200s in" the second half of the year, concluded HSBC analyst Frank Lee, who maintains a "buy" rating on the stock.

The upcoming earnings call will be a crucial test for Nvidia, determining if the company can sustain its dominance in the rapidly evolving AI landscape. Investors and the wider tech industry will be watching closely to see if Nvidia can deliver on the lofty expectations that have propelled it to the forefront of the global tech market.