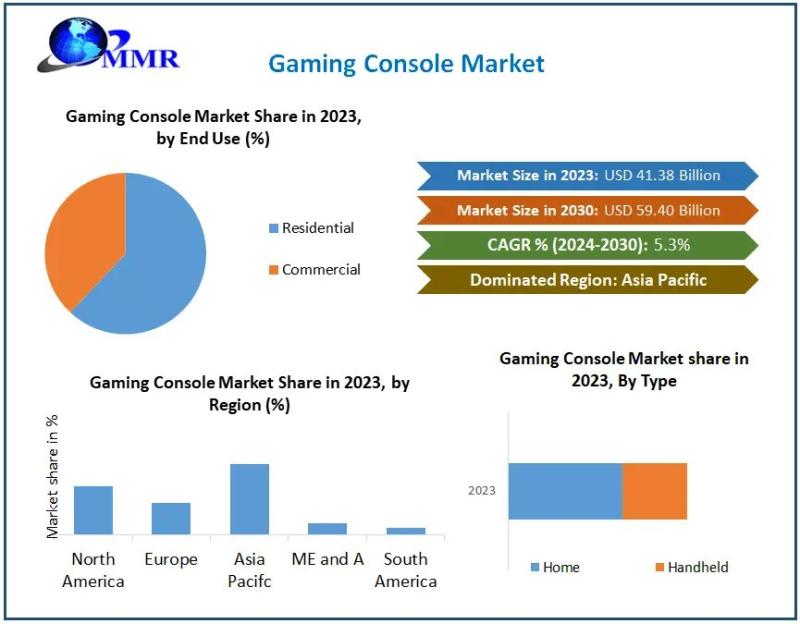

The global gaming console market is set for significant growth, with projections indicating a market value of USD 59.40 billion (£47.1 billion*) by 2030. This represents a compound annual growth rate (CAGR) of 5.3% from its 2023 value of USD 41.38 billion (£32.9 billion*). This expansion is driven by technological advancements, rising disposable incomes, and the evolving nature of gaming itself.

The market is dominated by established players such as Sony (PlayStation), Microsoft (Xbox), and Nintendo (Switch), who continuously release new consoles featuring improved hardware and software. These enhancements deliver superior visuals, smoother gameplay, and integrated services encompassing online multiplayer, streaming capabilities, and even virtual reality (VR) support. The increasing popularity of online gaming, coupled with greater consumer spending power, is a key factor in this market's expansion. This creates fertile ground for innovation in both hardware and software, leading to the development of new products and services.

Beyond traditional gaming, consoles are increasingly used for non-gaming applications. Streaming services, social media platforms, and fitness apps are now commonly integrated into modern consoles, broadening their appeal to a wider demographic beyond dedicated gamers. While the Asia-Pacific region, particularly China, Japan, and South Korea, is a significant growth driver due to its substantial gaming community and expanding middle class, North America and Europe maintain their positions as key markets.

Despite challenges posed by competition from mobile gaming and cloud gaming services, the console market remains robust. Technological innovation continues to push the boundaries of gaming experiences, attracting consumers seeking immersive and cutting-edge gameplay. Key drivers include:

Technological Advancements: Continuous improvements in graphics processing, storage capacity, and loading times enhance the overall gaming experience, making consoles an attractive option for gamers. The integration of VR and cloud gaming further expands possibilities.

Rising Disposable Incomes: Increased spending power, especially in developing economies, allows more consumers to invest in home entertainment, including gaming consoles.

Expansion of Online Gaming: The growth of online multiplayer platforms and subscription-based gaming services creates a more dynamic and social gaming experience, fueling demand for consoles.

Market trends further shape the landscape:

Cross-Platform Compatibility: The ability to play across multiple devices (consoles, PCs, mobiles) increases accessibility and enhances the social aspects of gaming.

Subscription Models: Game pass services and similar subscription models offer broader access to game libraries at a reduced cost, attracting a wider player base.

Virtual Reality (VR) Integration: The increasing integration of VR technology offers more immersive gaming experiences, creating a niche market for high-end, technologically advanced consoles.

Cloud Gaming: Cloud gaming services offer alternative access to games without requiring a physical console, potentially altering traditional gaming models and extending market reach.

Opportunities abound for growth within the market. The continued expansion of online gaming services presents significant potential for manufacturers to strengthen customer engagement and loyalty through enhanced online features and digital content distribution. Similarly, the continued development and adoption of VR technology, particularly in consoles, offers a lucrative avenue for attracting new gamers seeking immersive experiences.

Regional insights highlight the Asia-Pacific region's potential, driven by established gaming markets like Japan and South Korea, and the burgeoning gaming communities in rapidly developing economies such as China and India. Europe, with its established gaming culture, particularly in the UK, Germany, and France, remains a significant contributor to the market.

The market is segmented by type (home, handheld), application (gaming, non-gaming), and end-use (residential, commercial). A comprehensive list of major manufacturers includes Sony, Microsoft, Nintendo, and emerging players in cloud gaming and handheld devices.

*Exchange rates are approximate and may vary. This analysis is based on information available at the time of writing.