AI Revolution: 2 Tech Stocks Poised for Growth

Artificial intelligence (AI) has become a major driver for numerous tech companies, propelling the Nasdaq-100 Technology Sector index to a remarkable 78% surge since November 2022. While this technology is still in its nascent stages, its potential is undeniable.

The global AI market was estimated at £108 billion last year, and is projected to reach a staggering £659 billion by 2030. This presents a compelling opportunity for investors seeking long-term growth, as savvy purchases of robust AI stocks could prove highly lucrative.

Two companies stand out as prime beneficiaries of AI adoption, boasting reasonable valuations and promising prospects.

C3.ai: Riding the Wave of Generative AI Software Demand

As companies and governments embrace the power of AI, the demand for software enabling seamless integration of this technology will skyrocket. S&P Global Market Intelligence predicts the generative AI software market will experience a compound annual growth rate (CAGR) of 58% through 2028, reaching £41.6 billion in annual revenue by the end of the forecast period.

C3.ai (NYSE: AI), a leading provider of generative AI software, is capitalising on this growing demand. The company's revenue climbed 16% in fiscal 2024 (ending April 2024) to £246.6 million. Fiscal 2025 forecasts project revenue of £303.6 million, representing a 23% increase from the previous year, highlighting a positive shift in C3.ai's growth trajectory.

This growth is attributed to a surge in customer adoption of the company's enterprise AI software solutions. C3.ai offers both ready-to-use applications and custom AI development tools, empowering businesses to build and operate generative AI applications tailored to their specific needs. The company's software platform is accessible through leading cloud computing partners such as Google Cloud, Amazon Web Services, and Microsoft Azure.

C3.ai's strong performance is further evidenced by a 52% increase in the number of agreements signed in fiscal 2024, reaching 191. Notably, the company's partner network played a significant role, contributing 115 agreements, a 62% rise year-on-year. Moreover, the pipeline of qualified leads through the partner network grew by 63% in the same period.

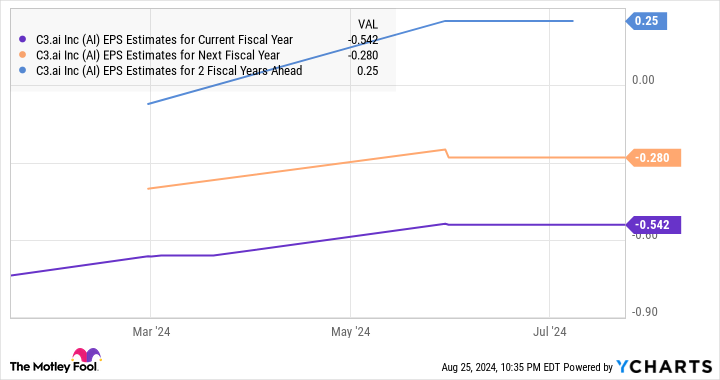

This positive momentum suggests a bright future for C3.ai, reflected in consensus estimates projecting a 51% CAGR for its bottom line over the next five years. As such, C3.ai presents a compelling long-term AI investment opportunity.

The stock currently trades at 9 times sales, a relatively affordable valuation compared to the U.S. technology sector's average price-to-sales ratio of 8. While the company isn't yet profitable, analysts anticipate profitability within a couple of years, driven by the anticipated acceleration in C3.ai's growth.

Qualcomm: Capitalising on the Generative AI Smartphone Boom

The resurgence of the global smartphone market, driven by the emergence of generative AI-enabled devices, is proving to be a boon for Qualcomm (NASDAQ: QCOM). This was evident in the company's fiscal 2024 third-quarter results (for the period ending June 23).

Qualcomm, a leading semiconductor specialist whose revenue is largely derived from smartphone chip sales, reported an 11% year-over-year increase in revenue, reaching £7.4 billion. Adjusted earnings soared 25% year-on-year to £1.85 per share. The chipmaker anticipates £7.8 billion in revenue in the current quarter, representing a 14% jump from the previous year.

Qualcomm's adjusted earnings are projected to rise by 26% on a year-over-year basis. This guidance indicates a continued growth trajectory, likely sustained by the significant opportunity in AI smartphones. Market research firm IDC predicts a staggering 336% surge in sales of generative AI smartphones this year, reaching 234 million units. By 2028, IDC anticipates annual generative AI smartphone shipments to reach a phenomenal 912 million units.

Qualcomm is poised to be a major beneficiary of this secular growth trend, with 63% of its revenue generated from smartphone processor sales. According to Counterpoint Research, the company holds an estimated 23% share of the global smartphone application processor market, and its chips are powering generative AI smartphones from major manufacturers like Samsung.

The generative AI opportunity is driving increased earnings growth expectations for Qualcomm from analysts. The company's bottom line is currently growing at a rate exceeding 20%, suggesting it may even outperform these expectations.

Qualcomm stock, trading at 22 times trailing earnings and 15 times forward earnings, presents an attractive opportunity, offering a discount to the U.S. technology sector's average earnings multiple of 46.

A Word of Caution and an Opportunity

Before investing in C3.ai, it's crucial to note that the Motley Fool Stock Advisor team, while identifying several promising investment opportunities, did not include C3.ai in their recent selection of the 10 best stocks to buy.

However, the team has a proven track record of success, delivering returns that have significantly outpaced the S&P 500 since 2002. Notably, their April 2005 recommendation of Nvidia has generated astounding returns, turning a £1,000 investment into a staggering £623,527.

The Motley Fool's Stock Advisor service provides a valuable resource for investors, offering guidance on portfolio building, regular updates from analysts, and two new stock picks each month.

While C3.ai might not be on their current top 10 list, the AI landscape is evolving rapidly, and the potential of these companies is undeniable. This makes both C3.ai and Qualcomm worthy of careful consideration for investors seeking to capitalize on the AI revolution.