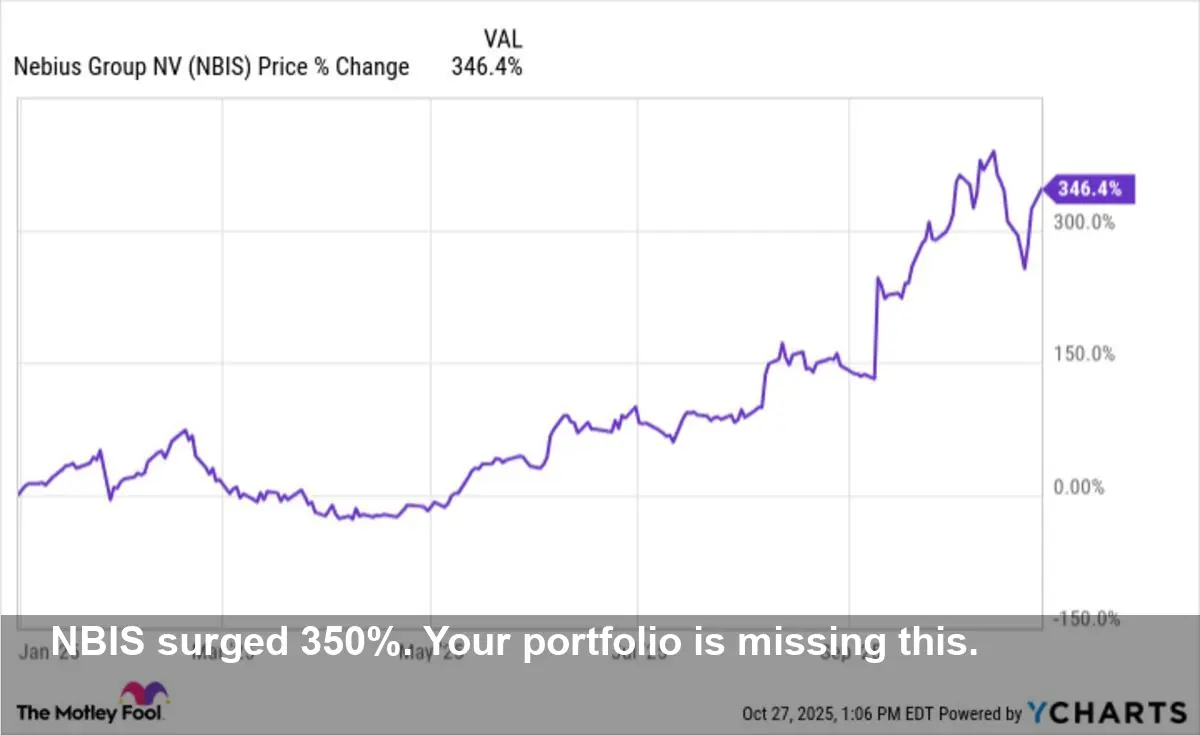

Nebius Stock: Up 350%, Did You Miss Out?

- Shares in AI infrastructure company Nebius Group (NASDAQ: NBIS) have skyrocketed by nearly 350% so far this year, significantly outperforming the broader market.

- The company recently signed a monumental five-year, $17.4 billion deal with Microsoft to expand its data center capacity, signaling massive growth potential.

- All eyes are on Nebius's third-quarter earnings report on November 11, where investors will seek clarity on the Microsoft partnership and future revenue guidance.

- Operating in the scorching-hot AI sector, Nebius provides essential GPU-based cloud services, placing it at the heart of the artificial intelligence revolution.

The Meteoric Rise of an AI Powerhouse

While the "Magnificent Seven" have dominated headlines, a new class of tech disruptors is capturing investor attention. Among them, Nebius Group (NASDAQ: NBIS) has emerged as a formidable player, with its stock price surging an astonishing 346% year-to-date. The company operates at the epicenter of the artificial intelligence boom, providing the critical infrastructure that powers the next generation of AI development.

What Does Nebius Do?

Nebius specializes in AI infrastructure as a service. In simple terms, the company acquires high-demand, high-performance graphics processing units (GPUs) from industry leaders like Nvidia and then rents out access to this powerful hardware through its cloud-based platform. This model is essential for companies that require immense computing power for AI training and deployment but cannot afford the massive capital expenditure to build their own infrastructure. With data centers spanning from the U.S. to Europe and Israel, Nebius is in a prime position to capitalize on the multi-trillion-dollar AI movement.

The Game-Changing Microsoft Megadeal

The primary catalyst for Nebius's recent rally is a landmark five-year, $17.4 billion deal with Microsoft. This agreement, aimed at expanding data center capacity, validates Nebius's business model and instantly elevates its status in the industry. Prior to the deal, management had set a goal of reaching a $1 billion annual recurring revenue (ARR) run rate by December—a target that the Microsoft partnership has now likely shattered, setting the stage for explosive growth.

What to Watch for on November 11

The upcoming Q3 earnings call is a pivotal moment for the company and its investors. Analysts and shareholders will be listening intently for management’s commentary on several key areas.

Details on the Microsoft Partnership

Investors will be eager for more details on the Microsoft collaboration and how it might evolve. The scale of the deal is unprecedented for Nebius, and any insights into its execution will be crucial.

Customer Diversification

While the Microsoft deal is a massive win, it also concentrates a significant portion of Nebius's revenue with a single client. The market will be looking for hints of potential new partnerships with other cloud hyperscalers like Amazon Web Services (AWS) or Google Cloud Platform to mitigate this risk.

Balance Sheet and Future Guidance

Building AI infrastructure is incredibly capital-intensive. Investors will want a clear picture of Nebius's capital allocation strategy and how it plans to fund future expansions. With the previous $1 billion ARR target now obsolete, any new long-term financial guidance will be heavily scrutinized as a measure of management's confidence.

Is It Too Late to Invest?

Given its rapid ascent, Nebius is considered a momentum stock, making it susceptible to volatility driven by hype. While the company is undeniably poised to benefit from powerful secular tailwinds in the AI sector, some analysts suggest a wait-and-see approach. The upcoming earnings call will provide a much-needed opportunity to assess whether the company's fundamentals justify its soaring valuation, or if investors should wait for a more reasonable entry point.